Thomson Reuters CLEAR for Unemployment Insurance

How to Stay Ahead of Fraud Through Record High Unemployment

With the staggering number of new claims and COVID-19’s long-term impact on the economy, unemployment agencies need secure and innovative, yet easy-to-use solutions to stay ahead of fraudsters without slowing down payments to citizens. Ensure your team has the tools it needs to prevent distribution to fraudulent claimants with a low-friction solution to verify large volumes of claimant identities.

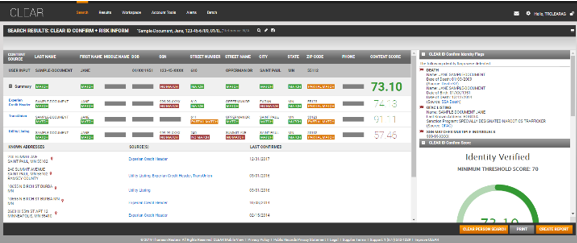

Verify identity information received with CLEAR ID Confirm

Verify the identity of large volumes of claimants with a customizable workflow to ensure a consistent process. Access the top credit agencies in the U.S., daily updated utility and phone files, corporate filing data, FEIN data, and much more. Prioritize results for additional review and keep your organization up to date.

Immediately identify potential fraudulent claimants

With a suite of tools, including CLEAR ID Confirm, teams can identify deceased, incarcerated or synthetic identities, as well as fictitious employers and businesses. Identify any risk associated with the subject you are investigating, such as deaths, redundant SSNs, OFAC listings, and businesses tied to the same FEIN.

Detect Sophisticated Fraud With An Integrated Solution

Implement Pondera, a Thomson Reuters company, for a comprehensive fraud detection solution to evaluate and identify sophisticated fraud structures. Improve your team’s productivity with a tool that identifies larger trends, patterns and clusters of suspicious activity over time that lead to fraud.

This comprehensive fraud, waste and abuse solution for unemployment insurance agencies can be implemented within 90 days. The combination of your agency data in the Pondera solution and Thomson Reuters CLEAR can deliver investigation-ready fraud leads.

Maximize your ROI through risk scores, alerts, powerful analytics and reporting capabilities, supported by a Special Investigations Unit to help you with complex, collusive fraud schemes.

See how CLEAR and Pondera will help you prevent fraud today by filling out the form to the right!

Ensuring CLEAR use is NOT for a prohibited FCRA purpose:

Using CLEAR for any purpose authorized by the FCRA is STRICTLY PROHIBITED. To keep your consumer fraud prevention and investigation activities within the bounds of authorized use, we've created guidelines to help you, which can be found here.

Thomson Reuters is not a consumer reporting agency and none of its services or the data contained therein constitute a “consumer report” as such term is defined in the Federal Fair Credit Reporting Act (FCRA), 15 U.S.C. sec. 1681 et seq. The data provided to you may not be used as a factor in consumer debt collection decisioning, establishing a consumer’s eligibility for credit, insurance, employment, government benefits, or housing, or for any other purpose authorized under the FCRA. By accessing one of our services, you agree not to use the service or data for any purpose authorized under the FCRA or in relation to taking an adverse action relating to a consumer application.

Talk to an Expert

© 2025 Thomson Reuters. All rights reserved. Use of Thomson Reuters websites and services is subject to the Terms of Use and Privacy Statement.